Investing is one of the most seemingly complex concepts for many. It is also one of the surest ways to grow wealth and achieve financial freedom. One of the most significant obstacles facing beginners and seasoned investors is figuring out what to do at various points in their investment journey. The investing world can be complex, with many options and strategies. Choosing the right resources can be particularly daunting for those embarking on this financial adventure.

Fortunately, a wealth of knowledge is available at our fingertips through books that cater specifically to beginners in the investing world. These books serve as guiding beacons. They provide insights, strategies, and valuable lessons that empower individuals to make informed investment decisions. This blog post will explore some of the best books on investing for beginners. Each offers a unique perspective and a wealth of information to help you kickstart your journey toward financial success.

Whether you’re a novice or looking to refresh your understanding of investment principles, these books are invaluable for your financial prosperity. Let’s dive into the world of investing literature and discover the essential reads that can shape your financial future.

Table of Contents

The 6 Best Books on Investing for Beginners

The Intelligent Investor, by Benjamin Graham

Benjamin Graham’s “The Intelligent Investor” stands as the quintessential guide to investment. Its enduring relevance is eloquently captured in this annotated edition, expertly updated by financial journalist Jason Zweig. As the most significant investment advisor of the 20th century, Graham laid the groundwork for value investing, a philosophy that has become the cornerstone for successful investors.

Initially published in 1949, the book has stood the test of time. It proves the efficacy of Graham’s strategies through various market conditions. In this revised edition, Zweig masterfully integrates the timeless wisdom of Graham with the contemporary realities of today’s market. The result is a comprehensive guide. It preserves the integrity of Graham’s original text and provides readers with insights and applications relevant to the present financial landscape. For seasoned investors and those new to the world of finance, this HarperBusiness Essentials edition is an invaluable companion, offering timeless wisdom for navigating the complexities of the stock market.

The Psychology of Money: by Morgan Housel

In The “Psychology of Money” by Morgan Housel, the author delves into the captivating intersection of psychology and finance, revealing that success with money is more about behavior than knowledge. Housel astutely observes that financial decisions are not made in a sterile mathematical environment but in the complex interplay of personal history, individual perspectives, ego, pride, and various external influences.

Eschewing conventional approaches that rely solely on data and formulas, Housel presents 19 insightful short stories that unravel the intricate ways people perceive and interact with money. The book acts as a guide, helping readers better understand this crucial aspect of life, where decisions are often made at the dinner table or in meeting rooms, influenced by personal histories and the myriad factors that shape our relationship with money.

Housel’s narrative is enlightening and relatable, offering timeless lessons on wealth, greed, and happiness. By exploring the nuances of human behavior in financial matters, The “Psychology of Money” provides readers with valuable insights, empowering them to understand and navigate the psychological aspects of their financial journey. This book is essential for anyone seeking a deeper understanding of the human side of finance and the keys to making sound and emotionally intelligent financial decisions.

If You Can: How Millennials Can Get Rich Slowly, by William J. Bernstein

If You Can: How Millennials Can Get Rich Slowly” by William J. Bernstein is a concise and invaluable guide for young investors navigating the complexities of financial planning. In this book, Bernstein advocates a simple yet powerful strategy for building wealth over time: consistently setting aside 15% of one’s salary into a low-cost target fund or a three-fund index allocation for 30 to 40 years.

The author addresses the Five Horsemen of Personal Finance Apocalypse—failure to save, ignorance of financial theory, unawareness of financial history, dysfunctional psychology, and the investment industry’s greed. By tackling these challenges head-on, Bernstein equips readers with the knowledge to overcome common pitfalls.

What sets this book apart is its accessibility. Bernstein distills complex financial concepts into understandable insights, making it an ideal resource for those without an extensive background in finance. The book educates readers and empowers them to make informed decisions about their financial future.

Bernstein’s generosity is evident in offering the booklet for free, emphasizing a commitment to financial education over profit. This gesture reinforces the book’s value as an essential resource for anyone seeking to enhance their financial literacy. In essence, “If You Can” is a roadmap to financial well-being. William J. Bernstein provides a clear, concise, and actionable guide for millennials and others eager to take control of their financial destiny. It is an indispensable tool on the journey to getting rich slowly, offering practical advice to help readers make informed decisions and avoid common financial pitfalls.

The Little Book of Common-Sense Investing by John C. Bogle

In The Little Book of Common Sense Investing, the late John C. Bogle, a pioneer in the world of mutual funds, imparts timeless wisdom on navigating the market’s complex landscape. Bogle’s key to successful investing lies in a simple yet powerful strategy: low-cost index funds. This classic guide advocates for a buy-and-hold” approach, emphasizing the importance of maintaining a diversified, low-cost portfolio over the long term.

Despite the market’s volatility since the book’s original publication in 2007, Bogle’s investment principles have remained resilient. The tenth-anniversary edition incorporates updated data and new information while preserving the book’s steadfast long-term perspective. Bogle introduces two new chapters on asset allocation and retirement investing, providing additional guidance for investors pursuing financial success.

The essence of Bogle’s philosophy is captured in the endorsement of legendary investor Warren Buffett, who praises Bogle for championing ultra-low-cost index funds. The book emphasizes that a portfolio centered on index funds ensures investors receive their fair share of stock market returns. This makes it a strategy favored by some of the most respected names in finance.

Recommended: 10 Principles of Wealth Building: Proven and Practical

Bogle’s insights guide readers on how to build a broadly diversified, low-cost portfolio without succumbing to the risks associated with individual stocks, manager selection, or sector rotation. The book encourages readers to focus on proven strategies that work in the real world, understand the sources of stock returns, and harness the magic of compounding returns while avoiding compounding costs.

The Little Book of Common Sense Investing is more than a guide; it’s a roadmap to financial stability. Bogle’s straightforward advice cuts through the noise of market trends and marketing hype, offering readers a solid foundation for their financial future. Whether you’re a seasoned investor or new to the world of finance, this book is an invaluable resource for those seeking a commonsense approach to building and preserving wealth over time.

Investing QuickStart Guide by Ted D. Snow, CFP, MBA

Ted D. Snow’s Investing QuickStart Guide (Second Edition) is a comprehensive and accessible resource that serves as the ultimate beginner’s guide to investing in 2022. As a Certified Financial Planner with over 30 years of investment experience, Snow brings knowledge to guide readers on their wealth-building journey. The book is a testament to Snow’s commitment to demystifying the complexities of investing. Written in plain English and tailored for new investors, it offers practical insights into making hard-earned money work effectively in the stock market. Snow addresses the fundamental question: How can one create real wealth and achieve financial freedom through strategic investments?

Covering a wide array of investment options, from stocks and mutual funds to ETFs, bonds, index funds, REITs, real estate, and commodities, the guide provides readers with a holistic understanding of various investment avenues. It stands out as the only investing book written by a CFP practitioner, adding a layer of credibility and practical expertise.

The Investing QuickStart Guide goes beyond the basics, delving into essential topics such as evaluating and comparing stocks and securities. Snow emphasizes disciplined approaches to investing, illuminating how these strategies can pave the way for early retirement and financial freedom. One of the book’s strengths is exploring how national and global economic factors and geopolitical events can impact investment prospects. Snow equips readers with the knowledge needed to make informed investment decisions by providing insights into the broader economic landscape.

Winning the Loser’s Game, by Charles D. Ellis

In “Winning the Loser’s Game,” Charles D. Ellis presents a timeless guide that transcends the ever-evolving investing landscape. In an era of technology, information overload, and the dominance of expert investors and computers, Ellis cuts through the complexity to reveal essential strategies for achieving lasting success in the financial markets. The book is a candid, concise, and accessible resource that empowers readers to navigate the challenges of investing by reducing costs, fees, and taxes. Drawing on his extensive career expertise, Ellis walks readers through developing and implementing a powerful investing strategy designed to yield consistent profits over the long term.

In this eagerly awaited new edition, Ellis addresses contemporary issues such as the impact of investor behavior on returns, the role of technology and big data, and the challenges traditional investment decisions face in this evolving landscape. New chapters on bond investing and insights into governance, developing comprehensive saving strategies, and the power of regression to the mean enhance the book’s relevance.

“Winning the Loser’s Game” emphasizes the enduring principles of successful investing that withstand the test of time. Ellis assures readers that despite market fluctuations, economic changes, and technological advancements, the core tenets of investment success remain constant. By the end of the book, listeners are equipped with the knowledge needed to make informed decisions and build a resilient investment strategy that endures market uncertainties and delivers long-term financial success.

Recommended: Investing the Warren Buffett Way: A Masterclass in Wealth Building

Parting shot

Having the right materials and mindset is the first step to successful investing. Navigating the complexities of the financial world requires a solid foundation, and the insights shared in this exploration of investment literature serve as invaluable building blocks. From understanding the psychological nuances of financial decisions to embracing disciplined approaches and adapting strategies to contemporary markets, these principles transcend specific titles. The key takeaway is that well-informed investors are better equipped to weather market fluctuations, make prudent decisions, and ultimately achieve financial goals. As you embark on your investment journey, remember that knowledge, combined with a thoughtful approach, is your most potent asset in pursuing financial success and security.

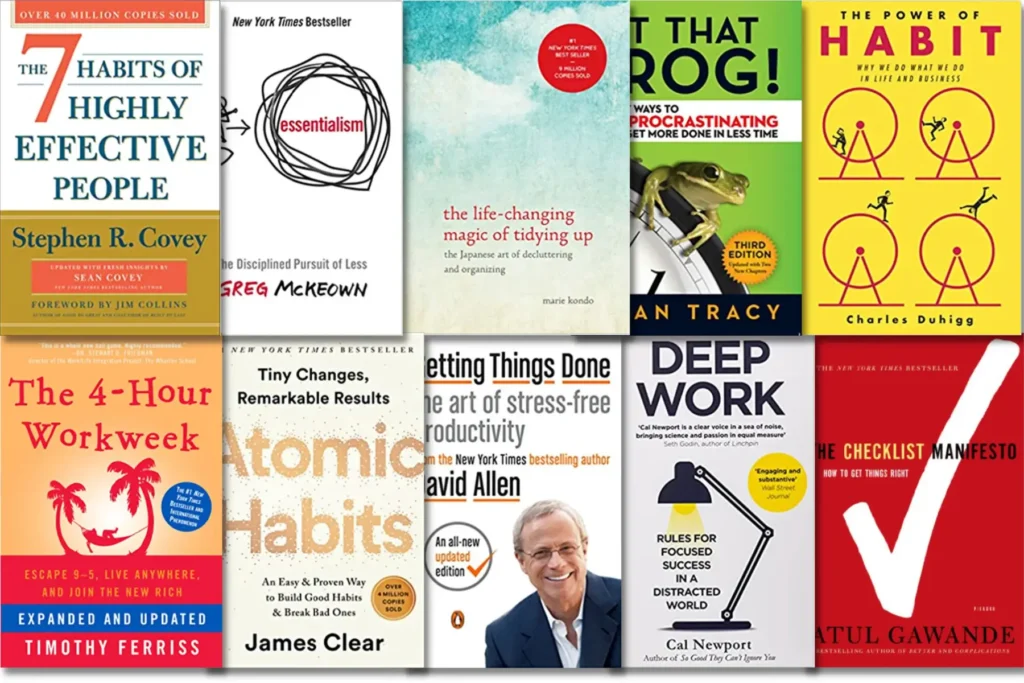

Related: Best Selling Productivity Books