Having debts on your shoulders can feel like a burden, significantly limiting your freedom of financial choices and building up tremendous stress. On the contrary, if you use the proper methods and a forward-looking attitude, the probability is reasonable that you will never enter the world of debt, and if you already have, you will learn how to stay out of debt completely and be in good financial books.

Herein, we will look into advanced strategies to help you stay out of debt completely. By taking the best bits of different advice and implementing them diligently.

Understanding Debt and Its Implications

One of the main reasons why individuals accumulate debt is because they generally borrow money that has to be repaid with interest. Whereas some debts like mortgages and student loans may be regarded as investments in your future, it is essential to note that excessive or irresponsible debt could be potentially dangerous for your financial well-being.

High-interest debts, such as credit card debt and payday loans, can quickly balloon out of control; therefore, it is important to address managing and, understanding how to avoid them.

The Psychological Impact of Debt

Just like that debt doesn’t operate from a money account, your mental health, too, will be affected. As a lot of the research evidence suggests, people who live in debt are more vulnerable to stress, depression, and anxiety.

Getting caught up in payment concerns can be easy, but it can quickly begin a downward spiral of bad financial decisions and emotional distress. In other words, debt avoidance is a financial goal and a way to achieve better well-being in general, which my financial plan promotes.

Apart from Psychological impact, debt can also impact in other ways like:

- Reduced Savings: Large debt payments can often cause you to be unable to keep the money for unexpected situations or save for dreams.

- Credit Score Damage: Failure to make debt payments can undoubtedly affect a credit score, thus limiting your options in the future, whether in employment or other modules.

- Limited Financial Freedom: Heavy debt may put you on troubled footing by the authorities not to allow significant life choices like purchasing a house or starting a business.

Strategies to Stay Out of Debt Completely

How to stay out of debt completely

1. Create and Stick to a Budget

A Budget is a financial guide you can use. It lets you monitor your take-home pay and expenditures to avoid living beyond your income. Here’s how to create an adequate Budget:

- List Your Income: Include all sources of income you have always had, such as a salary, free work, and dividend returns.

- Track Your Expenses: Track every expense and separate the essentials (rent, utility, groceries) from those that don’t matter (entertainment, dining out).

- Set Financial Goals: Set reasonable and reachable financial objectives. For example, building up an emergency fund or clearing off a loan.

- Adjust Accordingly: Periodically review the Budget and determine if any adjustments are required in response to changes in your financial condition.

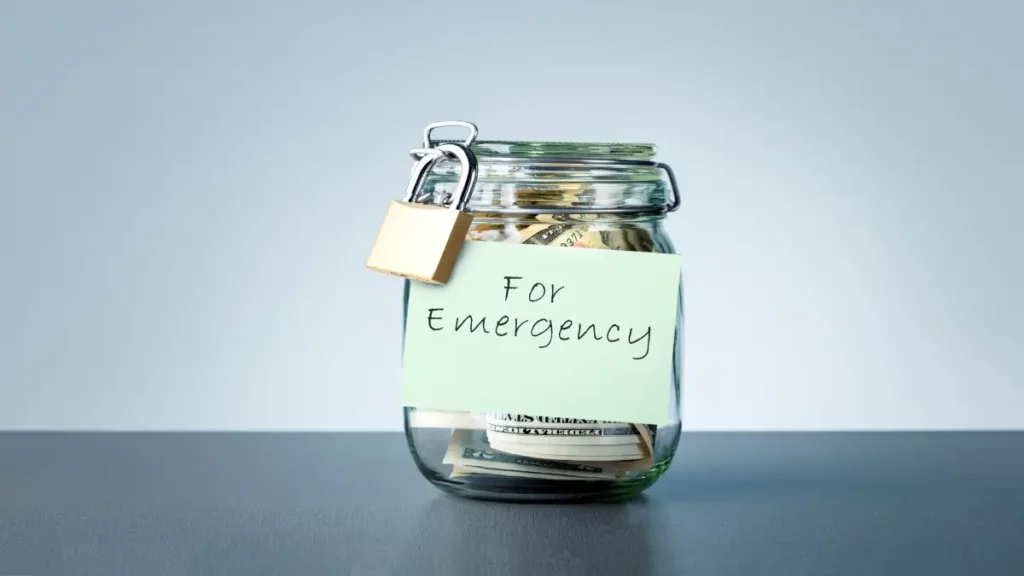

2. Build an Emergency Fund

An emergency fund is a buffer of financial safety that provides for unplanned expenditures, such as paying doctor’s bills, car repairs, or unemployment emergency funds. Set a goal to accumulate money equal to three months to a year’s expenses. This option guarantees you can evade using credit cards or loans during unemployment when earning money is impossible.

3. Avoid Unnecessary Credit Card Usage

Cards with credit may improve or deteriorate a situation, which is also true with other financial tools if one fails to use them properly. To avoid falling into credit card debt:

- Use Debit Over Credit: Prefer debit cards or cash for everyday purchases.

- Pay Full Balance Monthly: To avoid interest payments, always pay off your credit card balance in full each month.

- Limit the Number of Cards: Remove the most used credit cards to prevent a larger Budget than required and ensure that older items are quickly recalled.

4. Live Within Your Means

Preventing living beyond your means, where your earnings grow, so does your expenditure. Acquaint yourself with living frugally and making wants the least of your priorities. Look at every purchase critically and evaluate whether it is necessary and fits your spending plan.

5. Educate Yourself Financially

Financial literacy is essential as people can bargain to control the debts they get into. Knowing how banking functions and the resulting transfer of money to investments and into saving plans identifies you as a well-informed individual whose opinions on financial matters may be relied upon. Use online courses, websites, financial blogs, and books as supplemental learning materials.

6. Limit Loans and Financing

Only take out loans when necessary, and avoid financing non-essential items. Shop for the best interest rates and terms for essential loans like mortgages. Always read the fine print and understand the repayment obligations.

7. Automate Savings and Bill Payments

Automation of your finances can help you to be disciplined. Set up automatic bill payments from your savings account and enable online payment to minimize fees and penalties. It guarantees systematic savings and punctual payments, the antidotes to debt escalation

8. Regularly Review Your Finances

Regular business evaluations that cover the financial aspect can assist in tracking progress made in meeting specific goals. Reviewing your financial plan, expenditure, and emerging savings patterns at least every half year will also be wise. Reflect on the changes required in your financial Budget due to lifestyle changes, such as a new job, marriage, or childbirth.

9. Seek Professional Advice

Adults require direction in financial matters, which is where financial advisors can help out depending on a person’s wealth level. They can assist in developing a long-term personal financial plan and investment management and work with the client to minimize debt levels. Interestingly, there could be a cost associated with its acquisition, but the advantages mostly override the costs.

10. Be Mindful of Peer Pressure

To a significant extent, different aspects of social pressure can trigger people to spend more than necessary. Be aware of peer pressure to sustain a particular lifestyle. I have said before that it is always better to have financial stability rather than flash out to impress someone.

11. Utilize Tools and Resources

Several tools can be used in the management of personal finances. One tool that has been developed is the Credit Card Calculator on our website. This free card tracker calculates the time and total interest to clear the balance and payment according to current payments. It helps you to schedule payment of your debts and ensure you do not get caught in the cycle of debt.

12. Consider Debt Consolidation If Necessary

Deb consolidation may be considered if you pay off more than one loan. This includes adhering all of your loans into one loan with lower interest rates, thus making it easier to deal with and to clear. However, do not make a new loan during the repayment of the consolidated loan.

Additional Tips to Avoid Debt

Practice Smart Spending

Be a savvy consumer by practicing the following habits:

- Compare Prices: Always compare prices before making significant purchases.

- Use Coupons and Discounts: Take advantage of coupons, discounts, and cashback offers.

- Buy in Bulk: For non-perishable items, buying in bulk can save money in the long run.

Avoid Impulse Purchases

Many buyers succumb to the temptation of cross-selling products, which adds to the pressure of spending. For products that are not necessarily required immediately in the market, put a waiting period of some nature or type. After one week, think about whether it is still something that you really want and if you can afford it.

Maintain a Good Credit Score

A good credit score guarantees, for instance, favorable treatment in matters that require borrowing money. Timely payment of your bills, a low utilization ratio of the available credit, and refraining from applying for multiple credit cards within a short period are a few steps that will help you pay less to your credit card company.

Monitor Your Accounts Regularly

Always check your bank or credit card statements so that you notice that they have been charged unusually or that there have been mistakes. There are so many different ways to keep track of your finances and ensure that you don’t lose track of your money that you need to learn about and incorporate to ensure that your financial situation is always on the right track. Anything that goes wrong is corrected immediately.

Plan for Large Expenses

Hoard money for major expenses such as travel, house redecoration, or car buying. This eradicates the urgency of seeking credit or loans.

Communicate with Your Partner

Like any other facet of marriage, both partners should be accessible with each other on issues related to money. Both partners should have comparable visions and objectives concerning money matters, spending patterns, and how the finances will be managed.

Invest Wisely

It is a concurrent way of growing your wealth without necessarily having to break a sweat. If you are entering the world of investing for the first time, then there are various relatively safer investments, such as index funds or bonds, to consider. Try to get more information or consult professionals to avoid making wrong decisions on matters relating to the issue.

Stay Healthy

Healthcare costs can do more harm than good, mainly due to their high prices. People should wake up early in the morning, go to bed early at night, and ensure that they have a balanced diet to avoid frequent visits to hospitals and hefty bills. Preventive healthcare measures such as exercising, proper diet, and yearly checkups can help eliminate expensive diseases.

Leverage Employer Benefits

All employers offer some form of incentive, including pensions, health savings accounts, and flexible spending accounts, which may help some individuals save a lot of money or care less about financial issues.

Plan for Retirement

Start saving for retirement as early as possible. Contribute to retirement accounts like 401(k)s or IRAs, and take advantage of employer matching contributions if available. This ensures you have a financial cushion in your later years.

Conclusion

Avoiding debt takes time, effort, proper thinking, and the ability to think forward. Thus, a Budget, an emergency fund, no or restrained credit usage, and knowledge make for a financially comfortable and worry-free existence.

Just use our Credit Card Calculator—it is free and reliable and will assist you in managing your credit card repayment so you do not drown in debt. Implementing these strategies will ensure one does not incur debt and lay the foundation for a financially sound and happy life.